refinance transfer taxes new york

Income Tax Calculator New York 1ooo000000 The Billionaire Minimum Income Tax Impact and Its Future The proposed tax would increase revenue by 360 billion over ten years according to. Cash-out refinances have implications at.

10 Reasons To Move To Delaware Home Buying Tips Delaware Moving

Youre buying the least amount of protection of any deed.

. This new mortgage pays off the old one and the bank gives the excess funds to you in cash. Julie has been quoted in The New York Times the New York Post Consumer Reports Insurance News Net Magazine and many other publications. Some states such as North Dakota and New Mexico have no transfer tax at all.

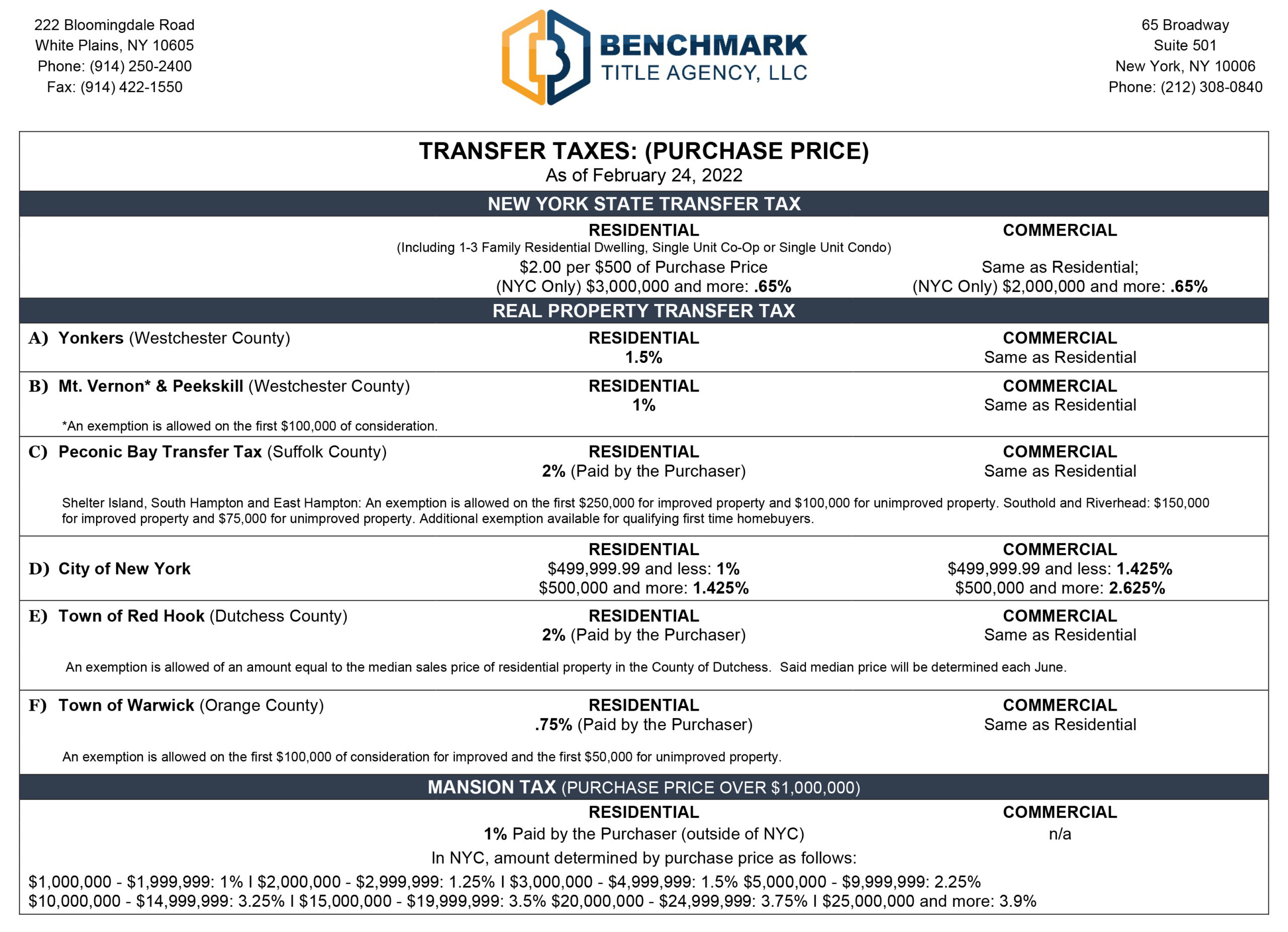

A cash-out refinance permits people to take equity out of their home by getting a new mortgage for a higher value than the previous one. Homeowners tend to refinance for two reasons. New York State transfer tax.

She is a vice president at BMO Harris Wealth management and a CFP. To get cash out and to lower their mortgage costs. New York City transfer tax.

Unfortunately for those moving from almost any other state in the US New York will seem mighty expensive. New York State equalization fee. Additionally if you live in one of the five boroughs youll.

For example Colorado has a transfer tax rate of 001 while people in Pittsburgh have to deal with a 4 rate. With a cash-out refinance you access the equity in your home but there are also tax implications. You may have to deal with different taxes deductions and credits.

Heres what you need to know. Transfer tax differs across the US. In New York State.

How real estate transfer taxes differ from other taxes. Properties of up to 500000. Your employer will typically withhold only state and local income taxes from your paycheck but you may also owe local taxes and other taxes depending on where you live.

Pickup or payoff fee. Also called a non-warranty deed a quitclaim deed conveys whatever interest the grantor currently has in the property if any. On top of sales tax hovering near 9 New York charges state income taxes that can tally up to an expensive percentage of your paycheck.

Miscellaneous condominium fees. What is the real estate transfer tax rate in New York. Julie Garber is an estate planning and taxes expert with over 25 years of experience as a lawyer and trust officer.

File state taxes for free Get Started with Credit Karma Tax 4. Local Economic Factors in New York.

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Mortgage Tax In Nyc Nestapple Biggest Commission Rebate

Here Are A Few Resources For Bookkeeping Tax Questions From Wayfare Accounting Llc Tax Questions Resources Scholarships

A Comprehensive Guide To The Nys And Nyc Transfer Tax Yoreevo Yoreevo

Here Are A Few Resources For Bookkeeping Tax Questions From Wayfare Accounting Llc Tax Questions Resources Scholarships

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Reducing Refinancing Expenses The New York Times

Clep Credit Undergraduate Admissions Admissions Undergraduate College Prep

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Saving New York State Mortgage Recording Tax Gonchar Real Estate

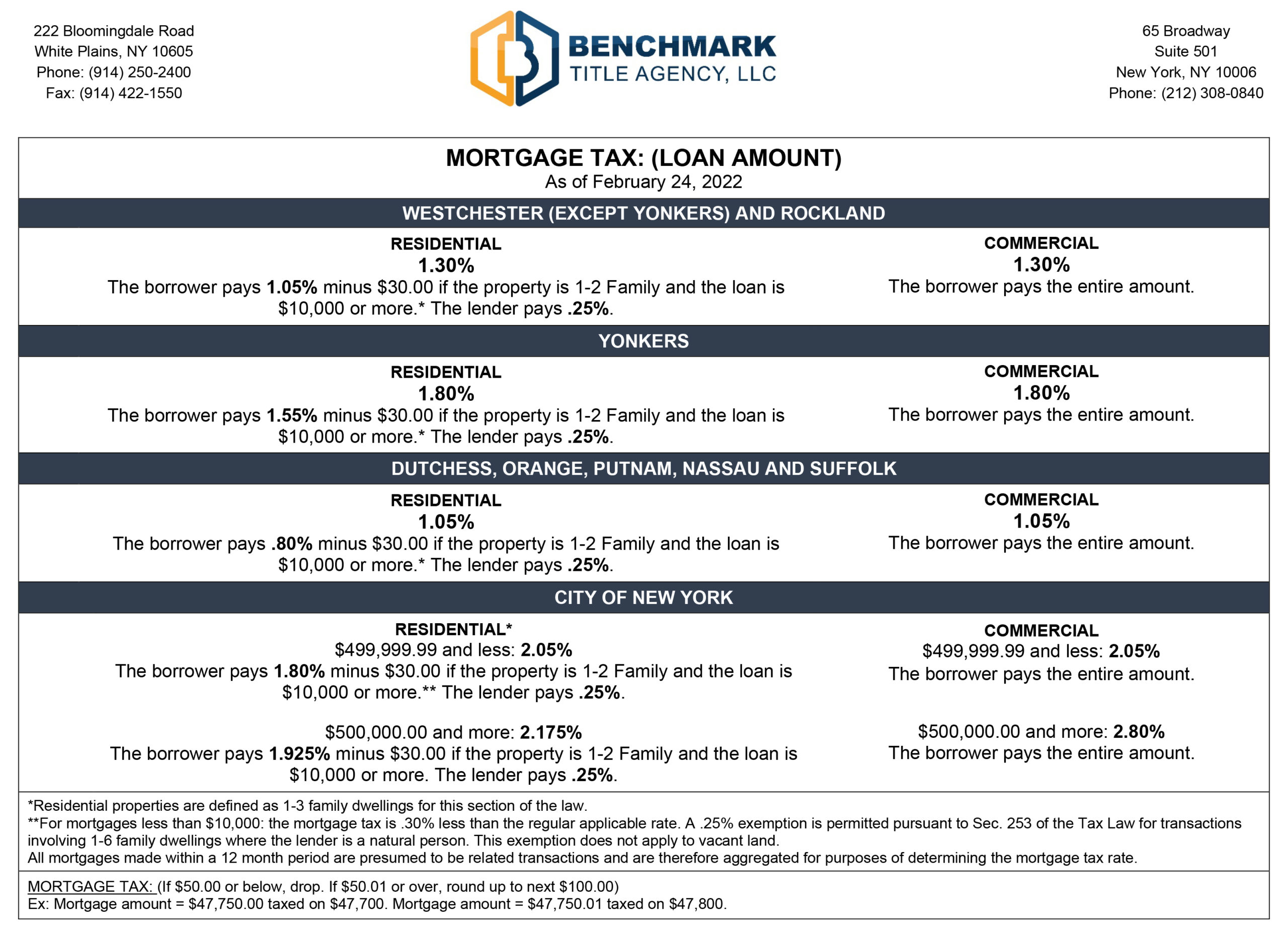

Mortgage Tax Transfer Tax Benchmark Title Agency Llc

Online Legal Advice From Expert Lawyers In India Vakilpro Advokat Finansy Septik

Online Legal Opinion Find A Lawyer From Vakilpro Com

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

Refinancing Your House How A Cema Mortgage Can Help

Nyc Transfer Tax What It Is And Who Pays It Streeteasy